Analytical Chemistry: An Indian Journal

ISSN (PRINT): 0974-7419

All submissions of the EM system will be redirected to Online Manuscript Submission System. Authors are requested to submit articles directly to Online Manuscript Submission System of respective journal.

Microfinance

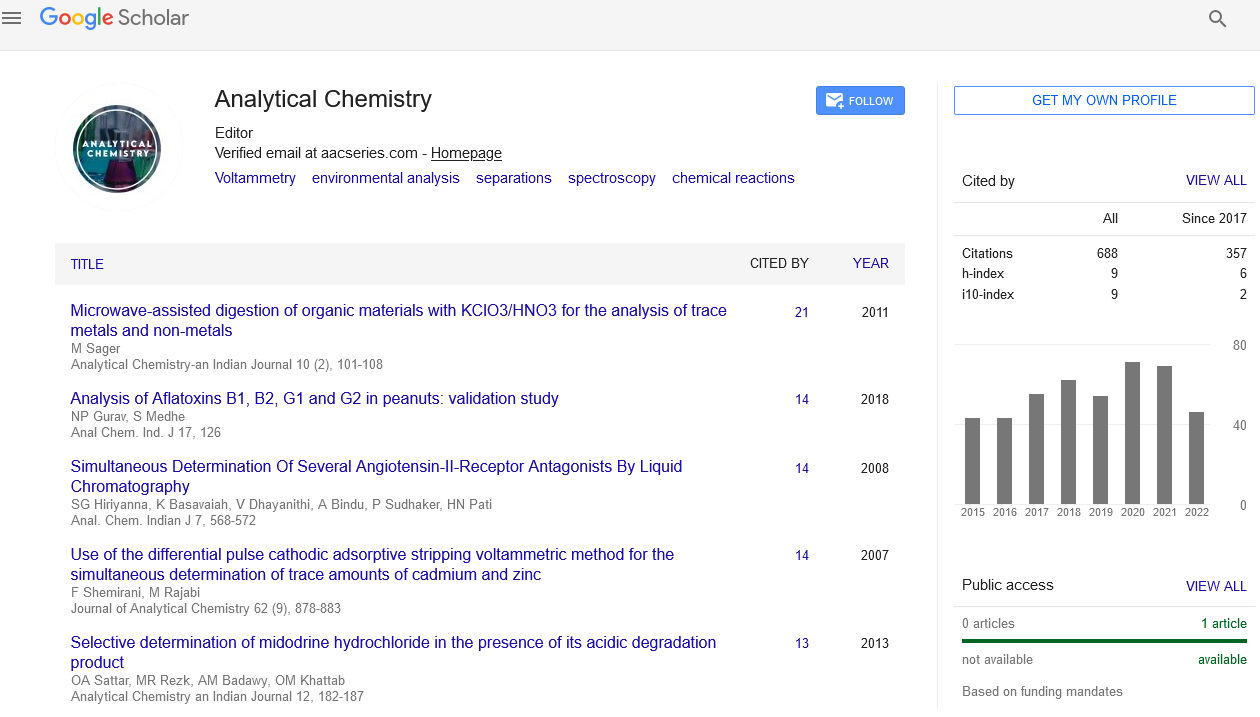

Microfinance, additionally called microcredit​, is a sort of banking administration gave to jobless or low-pay people or gatherings who in any case would have no different access to money related administrations. While organizations taking an interest in the region of microfinance frequently give loaning—microloans can go from as little as $100 to as extensive as $25,000—numerous banks offer extra administrations, for example, checking and investment accounts just as miniaturized scale protection items, and some even give monetary and business instruction. The objective of microfinance is to eventually offer ruined individuals a chance to become independent. Microfinance administrations are given to jobless or low-pay people on the grounds that the greater part of those caught in neediness, or who have restricted budgetary assets, need more pay to work with conventional monetary establishments. In spite of being prohibited from banking administrations, in any case, the individuals who live on as meager as $2 a day do endeavor to spare, obtain, procure credit or protection, and they do make installments on their obligation. Consequently, numerous needy individuals ordinarily look to family, companions, and even credit sharks (who regularly charge over the top financing costs) for help. Microfinance permits individuals to assume sensible private company advances securely, and in a way that is predictable with moral loaning rehearses.Google Scholar citation report

Citations : 378

Analytical Chemistry: An Indian Journal received 378 citations as per Google Scholar report

Indexed In

- CASS

- Google Scholar

- Open J Gate

- China National Knowledge Infrastructure (CNKI)

- CiteFactor

- Cosmos IF

- Electronic Journals Library

- Directory of Research Journal Indexing (DRJI)

- Secret Search Engine Labs

- ICMJE

View More

For Librarians